Cook County Minimum Wage to Increase July 1st

By Sally Weldin, Senior Human Resource Specialist

Published June 11, 2024

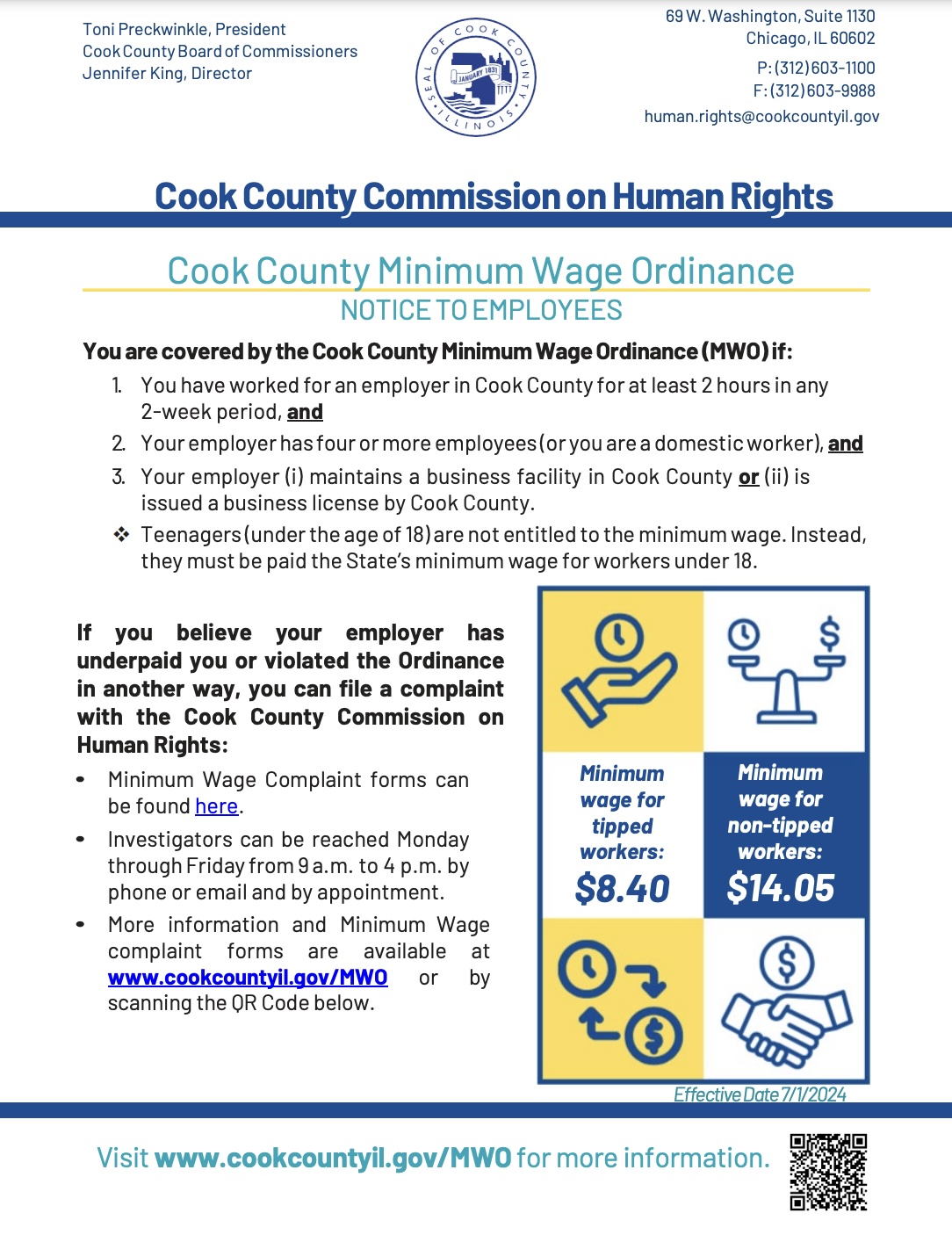

Effective July 1, 2024, the Cook County minimum wage will increase to $14.05 for non-tipped workers under Cook County’s Minimum Wage Ordinance. It will remain $8.40 for tipped employees. The Minimum Wage Ordinance applies to hourly, salaried, and tipped employees over the age of 18, working in Cook County.

If a Cook County employer is in a municipality that opted out of the Ordinance, it must pay the Illinois minimum wage of $14.00. Also, employees covered under Chicago’s Minimum Wage Ordinance are exempt from the increase. There will be an increase to Chicago’s minimum wage on July 1, 2024, as well.

An employee is a covered employee under the Ordinance if all of the following are true:

- The employee has worked for an employer in Cook County for at least two hours in any two-week period.

- The employer has four or more employees (or the employee is a domestic worker).

- The employer maintains a business facility in Cook County or is issued a business license by Cook County.

Covered employees must be physically present and work two hours in a two-week period within the geographic borders of Cook County for the minimum wage to apply.

The Ordinance recognizes that uncompensated commuting or traveling through Cook County, without stopping for a work purpose, are not counted as compensable time. Examples of stopping for a work purpose include making deliveries or sales calls. Stopping for a work purpose would not include making only incidental stops for purchasing gas or buying snacks.

While the Ordinance does not require employees under the age of 18 to be paid the Cook County minimum wage, the Illinois Minimum Wage Act requires teenage employees to be paid a minimum wage of $12.00 per hour, with annual increases.

Employers must also post the new Cook County minimum wage poster and make it available electronically as applicable.

For employees who experience a pay change based on the new minimum wage, employers must document the new rate in writing with the effective date.

Questions? Members can contact the HR Hotline Online or at 800-448-4584.